Security | Threat Detection | Cyberattacks | DevSecOps | Compliance

August 2023

Your HTTPS Redirection Risk Exposure

Introducing Riscosity's New Look

Today you’ll notice our new logo and typography. We’ve introduced a minimalist approach and opened up spacing within the letters to help with legibility and visual continuity. Our mission as a company is to help teams quickly and painlessly meet data security requirements with high confidence. Our goal is to align that mission with our user's entire experience, from day one.

4 Ways To Improve Your Cloud Security Posture Management

The Role of Software in Vendor Risk Management Products

How to Conduct a Vulnerability Assessment

What Role Does Procurement Play in Supply Chain Risk Management?

Top 5 Challenges and Solutions in Managing Third-Party Risks

Predicting the stability of security ratings over time

The concept of ratings has been the accepted standard for making investment decisions. The first commercial credit reporting agency, the Mercantile Agency, was founded in 1841. While this relied on largely subjective methods of evaluation, it wasn’t until the 1960s, when credit reporting became computerized, that the industry consolidated and took off. Since then, credit and financial ratings models have progressed to become objective and trustworthy data points that inform lending decisions.

Supply Chain Resilience: 4 Ways to Get Ahead of Third-Party Cyber Risk

Road to DORA and PS21/3 Compliance: Leveraging Technology to Reduce Risk

Introducing Bitsight Third-Party Vulnerability Response

Cybersecurity's Crucial Role Amidst Escalating Financial Crime Risks

In an era of escalating financial crimes, the spotlight shines brightly on the rising concerns in the realm of cybersecurity. According to a recent survey, a staggering 68% of UK risk experts anticipate a surge in financial crime risks over the next year. These apprehensions echo globally, with 69% of executives and risk professionals worldwide foreseeing an upswing in financial crime risks, predominantly fueled by cybersecurity threats and data breaches.

The SEC's New Cybersecurity Regulations: Understanding the Impact for Companies & Their Shareholders

NetApp + SecurityScorecard Core Testimonial

3 Best Practices for External Attack Surface Management

8 Key Elements of a Third-Party Risk Management Policy

Key Steps to Developing an Effective Third-Party Risk Management Program

Choosing Automated Risk Remediation Software (in 2023)

How to Build a Risk Register for Your Business

Checklist for Third-Party Risk Assessments

What are the Principles of Information Security?

What Is Financial Crime Risk Management (FCRM)?

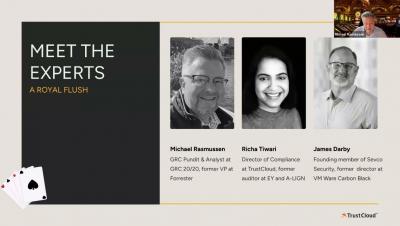

Play Your Cards Right: How to Adapt Your GRC Program to the Modern Tech Stack

Want to Reduce Your Cyber Risk? Increase Diversity!

Introducing Snyk's new Risk Score for risk-based prioritization

We’re happy to announce the open beta availability of Snyk’s new Risk Score! Replacing the existing Priority Score, the new Risk Score was designed to help you prioritize more effectively by providing you with an accurate and holistic understanding of the risk posed by a given security issue.

What is Cybersecurity Risk and How Can You Manage It?

Protecting the Empire State

Governor Kathy Hochul recently unveiled New York’s first-ever state-wide cybersecurity strategy, intended to protect the state’s digital systems and infrastructure from the ever-growing presence of cyber threats.

6 Myths About Cybersecurity Ratings (and 1 Truth)

Today, electricity is so ubiquitous that it’s difficult to perform even basic tasks without it. But when electricity was first introduced, it took decades for broad acceptance and adoption because it was misunderstood and misused. Slowly, the benefits began to outweigh the cons. As with any innovation, there are setbacks, but electricity has overwhelmingly been a force for good. The same can be said about cybersecurity risk ratings. Are they perfect? No.

New SEC cybersecurity rules: Five things every public company CISO should do now

Positive Risk vs. Negative Risk in Enterprise Risk Management

Businesses face risk all the time – and that’s OK. Even though the word “risk” typically has negative connotations, the term can actually represent many situations, not all of them unfavorable. ISO 31000 states that risk is the “effect of uncertainty on objectives.” That actually means risk can come in two types: positive and negative.

How to Negotiate the Best Cyber Insurance Policy

Cybersecurity in the Entertainment Industry: Risks and Solutions

What is a Whaling Attack and How to Prevent It

7 Third-Party Risk Management Trends to be Aware of in 2024

Choosing Automated Vendor Risk Remediation Software (in 2023)

What is Cyber Insurance? (And Is It Worth the Costs?)

Spot risks with our new IP view

Customers often tell us of instances where someone in their team spins up a new machine that isn’t using an approved geolocation, or that they see an unexpected spike in hosting from a particular country. These anomalies can put an organization at risk, especially since they are difficult to spot in an automated way.

NIST Cyber Risk Scoring

An Easy Guide to Understanding Risk Management and Quantification, Part 1

What Data Breaches Tell Us: An Analysis of 17,000 U.S. Data Breaches

Attack Surface Intelligence - Promo

Managed Cyber Risk Services - Promo

Salesforce Importer

Episode 1: SSC Incident Responders vs Brazilian Hackers

Episode 2: ASI Prevents Deadly Flood in Italian Town

Episode 3: SecurityScorecard Equifax Breach Congressional Enquiry

Safeguard Your Business From the Risks of Social Media

CIS Critical Security Controls: What Are They and How Can You Meet These Standards?

Top 5 Security Vulnerabilities of 2023

2023 is a year of “digital forest fires.” The MOVEit and the Barracuda Networks’ email supply chain attacks underscore the massive butterfly effect a single software flaw can have on the threat landscape. Supply chain attacks spread like a forest fire. Once cybercriminals compromise widely used software, attackers gain access to potentially all organizations that use that software.

The Importance of Security Risk Assessments and How to Conduct Them

IT risk assessments are vital for cybersecurity and information security risk management in every organization today. By identifying threats to your IT systems, data and other resources and understanding their potential business impacts, you can prioritize your mitigation efforts to avoid costly business disruptions, data breaches, compliance penalties and other damage.

What Is Risk Communication?

SEC Adopts Cyber Disclosure Rule

Why Independent Benchmarking Data is a Critical Part of SEC Cybersecurity Disclosure Strategy

Choosing a Financial Services Cyber Risk Remediation Product

Choosing a Tech Cyber Risk Remediation Product (Key Features)

3 Tips for Improving your Cybersecurity Intelligence

Security Misconfigurations: Definition, Causes, and Avoidance Strategies

Highlights & Insights of a Cyber Risk Quantification Journey

New SEC Cyber Requirements Unite Security Leaders and Business Stakeholders

Why cyber insurance should be part of any comprehensive risk management strategy

The recent rise of ransomware, attacks on supply chains and increasing costliness of privacy regulations has made cyber insurance an important topic of discussion. But it can be tricky to keep up with cyber insurance requirements. One of the most robust ways to meet those requirements is with multi-factor authentication (MFA).