Case Study - Electronic Gift Card Fraud Investigation Uncovers Contractual Risks

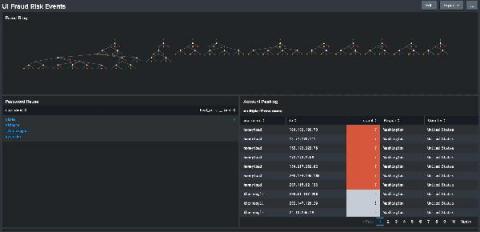

Having closed brick-and-mortar operations on March 16, 2020 for safety reasons, the nearly overnight shift to a purely e-commerce revenue model brought uncertainty. However, a rapid uptick in online sales provided a sense of relief, albeit short-lived. Our client became concerned when a closer look at the online transactions revealed an unusually large volume of electronic gift card purchases made using their private label credit card.