Security | Threat Detection | Cyberattacks | DevSecOps | Compliance

Finance

State of API Security for Financial Services and Insurance

Monitoring Financial Data Security And What To Know

The Fintech industry deals with financial and personal data of customers on a massive scale. From credit card transactions to identity verification details, companies collect and process huge amounts of sensitive data, making them an attractive target for cybercriminals. To ensure the highest standards of data protection and risk management, constant monitoring and analysis of security data is crucial.

Mitigating Risks for Forex Brokers

12 Best Practices for Banking and Financial Cybersecurity Compliance

Financial data is a desired target for cybercriminals. Hackers frequently attack financial institutions such as banks, loan services, investment and credit unions, and brokerage firms. Security incidents in the financial sector are extremely expensive (surpassed only by the healthcare industry), with the average total cost of a data breach reaching $4.35 million in 2022.

Financial Services is Leading the Pack in Placing Controls Around ChatGPT

ChatGPT use is increasing exponentially in the enterprise, where users are submitting sensitive information to the chat bot, including proprietary source code, passwords and keys, intellectual property, and regulated data. In response, organizations have put controls in place to limit the use of ChatGPT. Financial services leads the pack, with nearly one in four organizations implementing controls around ChatGPT.

Banking and Retail Top the List of Industries Targeted by Social Media Phishing Attacks

Using an external platform trusted by potential victims is proving to be a vital tool in the cybercriminal’s arsenal. New data shows the state of the threat and who’s at risk. The average business experienced around 81 social media attacks each month in Q1 of this year, according to new data from PhishLabs, increasing 12% over Q4, 2022 and 5% over Q1 of 2022.

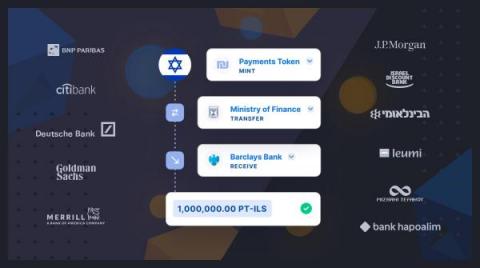

Project Eden: The Technical Perspective

12 of the most prominent banks gathered at Tel Aviv Stock Exchange (TASE) on May 31st, 2023, to participate in Project Eden, a highly-anticipated PoC of the first digital government bond issued by the Israeli Ministry of Finance. International and domestic banks – Barclays, BNP Paribas, Deutsche Bank, Goldman Sachs, J.P.

The role of cybersecurity in financial institutions -protecting against evolving threats

Cybersecurity is practice of protecting information technology (IT) infrastructure assets such as computers, networks, mobile devices, servers, hardware, software, and data (personal & financial) against attacks, breaches and unauthorised access. Due to bloom of technology, most of all businesses rely on IT services, making cybersecurity a critical part of IT infrastructure in any business.

Cybersecurity Standards in the Banking Industry

Cybersecurity has risen to become a major concern for nearly every industry. With the constant stream of news about the escalating numbers of breaches, it is understandable that governments have taken a more active role by passing cybersecurity and privacy legislation. Some of the industries are not top of mind to many people. For example, few people are aware of all of the industries that make up the 16 sectors of critical infrastructure.