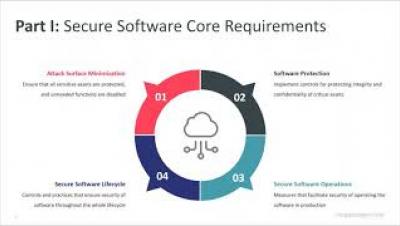

New PCI Regulations Indicate the Need for AppSec Throughout the SDLC

The PCI Security Standards Council (SSC) is a global organization that aims to protect payment transactions and consumer data by developing standards and services for payment software vendors that drive education, awareness, and implementation. Since payment software is constantly changing, the SSC is constantly evolving and adapting its standards to ensure that vulnerabilities and cyberattacks are minimized.