Security | Threat Detection | Cyberattacks | DevSecOps | Compliance

PCI

PCI DSS reporting details to ensure when contracting quarterly CDE tests

This is the second blog in the series focused on PCI DSS, written by an AT&T Cybersecurity consultant. See the first blog relating to IAM and PCI DSS here. There are several issues implied in the PCI DSS Standard and its associated Report on Compliance which are rarely addressed in practice. This occurs frequently on penetration and vulnerability test reports that I’ve had to assess.

Identity and Access Management (IAM) in Payment Card Industry (PCI) Data Security Standard (DSS) environments.

Many organizations have multiple IAM schemes that they forget about when it comes to a robust compliance framework such as PCI DSS. There are, at minimum, two schemes that need to be reviewed, but consider if you have more from this potential, and probably incomplete, list: Bottom line, in whatever fashion someone or something validates their authorization to use the device, service, or application, that authorization must be mapped to the role and privileges afforded to that actor.

Risks of credit and debit card Fraud: Why PCI DSS is Essential?

The Advancement in technology and online payment transaction has offered an immense amount of convenience to both consumers and businesses. The ease and widespread acceptance of online payment including the credit/debit card transaction has streamlined business processes and payment transactions greatly.

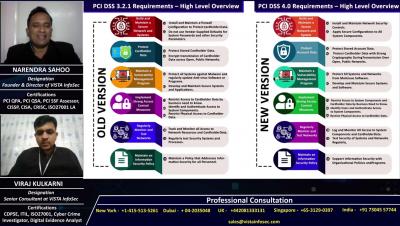

Earning a 4.0: The Shift in PCI Compliance Requirements Is Underway

PCI 4.0 — the PCI Standards Security Council’s first update since 2018 to the PCI Data Security Standards (PCI DSS) — is a major iteration that shifts away from the traditional point-in-time assessment. Do you remember how an auditor would annually determine the PCI compliance status of a merchant’s or service provider’s system on a specific day in a specific month and assume — somehow — that the snapshot characterized their status all year?

7 keysteps for PCI DSS 4.0 readiness assessment

PCI Compliance Done Right with Splunk

The New Year brings with it so much to look forward to and we are happy to bring even more to be excited about: a new release for the Splunk App for PCI Compliance. Starting January 11th, version 5.1 will be Generally Available. In this blog, let's review the main benefits of the Splunk App for PCI Compliance and highlight the improvements that version 5.1 brings.

The Payment Card Industry Data Security Standard

As a CIO, you're likely familiar with the Payment Card Industry Data Security Standard (PCI DSS). But what do you know about it? PCI DSS is a set of requirements designed to protect credit and debit card data. It applies to anyone who processes, stores, or transmits payment card information.

What is PCI Compliance?

In today’s fast-moving and competitive marketplace, you can barely find any businesses and merchants that still haven’t adopted the use of credit cards for their services. More than a third of American cardholders use credit cards for their transactions on a monthly basis. With the rising prevalence of identity theft, over 1.1 billion personal records were exposed by data breaches and credit card fraud alone.

3 Steps To Remain PCI Compliant with your AWS Configuration

Becoming and staying PCI compliant both take a lot of work. Developers are often already swamped with an endless list of tasks, and adding PCI compliance can be overwhelming. Security awareness is one thing, but a set of requirements is entirely different. It means you have less freedom in how you wish to implement security in your application, and you must understand the requirements demanded by your organization.