Security | Threat Detection | Cyberattacks | DevSecOps | Compliance

Fireblocks

Fireblocks gears up for the crypto bull run with our latest executive hires

The Rise of the Blockchain Architect

Fireblocks Integrates with BCB Group's BLINC to enable Fiat Transfers Across Major Global Currencies

How to protect your business from NFT phishing attacks and spam

XYZ Teknoloji Launches Compliant Digital Asset Solution for Banks and Financial Institutions using Fireblocks

Flipkart launches 3.6 million wallets for Web3 brand engagement program using Fireblocks

India-based e-commerce giant Flipkart is utilizing Fireblocks’ Wallets-as-a-Service to seamlessly create wallets on their FireDrops app, providing a user-friendly and highly integrated Web3 experience for their customers. To date, over 3.6 million active wallets have been created on the platform.

Igniting Innovation at SPARK '23: Day One Highlights

Fireblocks’ second annual user conference, SPARK ‘23, saw nearly 600 attendees representing over 300 companies in the digital asset and crypto space. Kicking off the conference was the welcome reception, which featured a spectacular drone show. The display set the tone for what SPARK is about – innovation and community. The conference empowers customers to maximize the full potential of the Fireblocks platform while forging new alliances with fellow leaders.

Ledger Connect Attack: What You Need to Know

On December 14, 2023, the Ledger Connect Kit was compromised, allowing attackers to drain users’ wallets on dozens of decentralized apps. Fireblocks’ customers were not impacted by the attack. Fireblocks dApp Protection, the latest security feature in our DeFi solution, detected and prevented customers from unknowingly interacting with the impacted dApps.

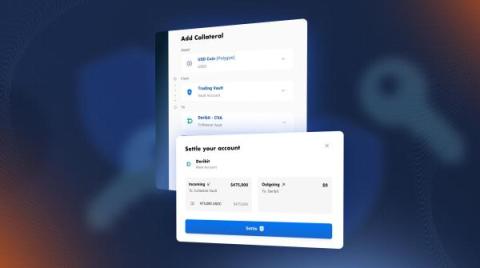

Fireblocks Launches Off Exchange to Eliminate Counterparty Risk

Today, Fireblocks is launching Off Exchange – a new solution that enables trading firms and asset managers to trade on centralized exchanges from an on-chain MPC shared wallet, eliminating exchange counterparty risks.