Product Update: SMS TxN Extractor-The future of income proof and financial profiling

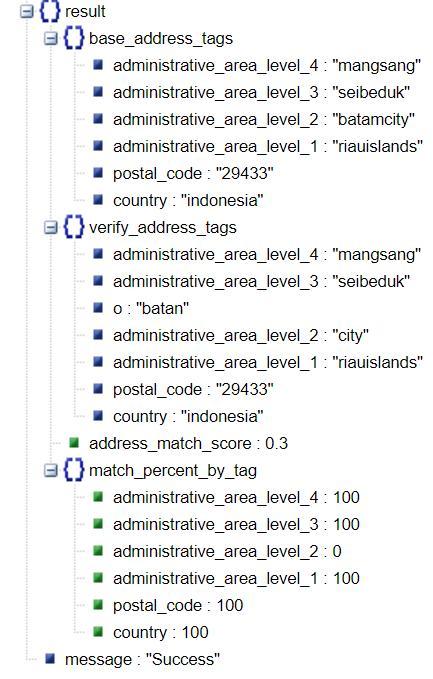

With our continuous pursuit to help businesses reduce the blind spots in business metrics, we have come up with yet another feature that will prove to be the richest source of financial data, i.e SMS TxN Extractor. SMS was believed to be a dead market until people began to understand the reliability. Apart from the concept of reliability of SMS messaging, texts are quick, cost-effective and results can very quickly be analyzed.