Blockchain Revolution in Finance: Securing Accounting Practices

Ever wondered how blockchain could revolutionize finance and accounting?

As you dive into the world of finance, blockchain technology is making waves, reshaping conventional accounting practices.

This piece will guide you through the groundbreaking changes propelled by blockchain. You'll learn how it shifts from double-entry to triple-entry accounting, enhances transparency, and mitigates fraud risks.

Keep reading to discover how embracing blockchain can catapult your business into the future of finance.

Understanding Blockchain Technology

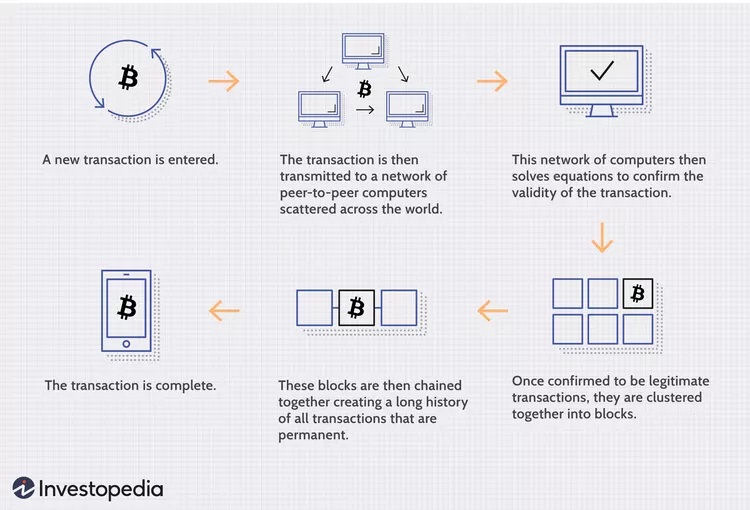

Essentially, blockchain is a digital ledger of transactions, duplicated and distributed across an entire network of computer systems. Each block contains a number of transactions, and every time a new transaction occurs, a record of that transaction is added to every participant's ledger.

It's decentralized and highly secure, thanks to complex cryptography that guards against fraud and hacking.

In accounting, blockchain offers potential for increased accuracy, transparency, and security. It's not just about cryptocurrencies – this technology can revolutionize how we record, verify, and report all financial transactions.

The Value and Benefits of Blockchain

Blockchain technology provides a decentralized and transparent ledger, reducing the risk of fraud and manipulation. It's like having a public, tamper-proof history of all financial movements, increasing transparency and accuracy.

Moreover, blockchain can streamline the auditing process. Because each transaction is immutable, auditors can trust the data's integrity, saving time and resources.

Plus, it enhances security, as each transaction is encrypted and linked to the previous one, creating a chain that's nearly impossible to hack.

Exploring Smart Contracts

Let's now delve into the examples of blockchain in accounting, starting with smart contracts.

Think of smart contracts as self-executing deals, with the terms directly written into lines of code. They're not only contracts in the traditional sense, but they can carry out transactions without the need for intermediaries.

Just imagine you're in a vending machine scenario. You select an item, pay for it, and the machine releases your purchase. That's how smart contracts work. When conditions are met, actions are triggered.

From a business perspective, this means a dramatic reduction in time and cost. You'll see smoother operations, heightened efficiency, and increased trust.

With smart contracts, blockchain is truly rewriting the rulebook for financial transactions.

Blockchain's Impact on Auditors

If you’re an auditor, embracing blockchain technology promises to dramatically transform your approach to verifying financial transactions. Here's how:

- Enhanced Transparency: Blockchain's public ledger allows you to view all transaction data in real-time, increasing transparency and reducing the time spent on manual verification.

- Improved Efficiency: The use of smart contracts automates various auditing processes. This automation allows you to focus more on analysis rather than routine checks.

- Fraud Reduction: Blockchain's immutable nature means that once a transaction is recorded, it can't be altered. This significantly reduces the risk of fraud and gives you peace of mind about the accuracy of the data.

In essence, blockchain technology could streamline your work, making you more efficient and your audits more reliable.

Limitations and Implications of Blockchain

While blockchain technology holds incredible potential for transforming the financial landscape, it's also essential to consider its limitations and implications.

For instance, scalability can be an issue. Can the blockchain verify transactions fast enough to keep up with high-volume businesses?

There's also the question of governance. Who's making the decisions for the blockchain, and how do these influence your operations?

Interoperability is another consideration. It's crucial to ensure blockchains can connect with other systems and pull historical data.

And, of course, privacy is paramount. How can customer and corporate data be protected and shared on a need-to-know basis?

As you navigate the blockchain revolution, it's vital to keep these implications in mind.

Blockchain's Role in the Accounting Industry

A significant number of accounting tasks can be revitalized by integrating blockchain technology. As you dive into this new landscape, here are some key points:

- Automation of Tasks: Blockchain can automate routine tasks such as data entry and reconciliation. It's all about reducing manual intervention and human error.

- Transparency and Accuracy: With blockchain, every transaction is recorded and verified in real-time. This increases the accuracy of your financial reports and makes them more trustworthy.

- Fraud Prevention: As mentioned above, blockchain's immutable nature makes it nearly impossible to alter or delete a recorded transaction. This helps to reduce fraud and manipulation in financial records.

Future of Accounting With Blockchain

By now it's already clear that blockchain technology holds immense potential for reshaping the accounting industry. Imagine a future where:

- Transactions are automatically recorded and verified, minimizing human error and reducing fraud.

- Audits are simplified and streamlined, providing real-time financial oversight.

- Compliance becomes a breeze as transparency is hardwired into the system.

Blockchain's promise lies in its ability to replace the old double-entry accounting system with a more secure, efficient, and transparent triple-entry system.

It's a future where you can trust the data you see, as it's been verified by a network of computers rather than a single entity.

Conclusion

You're on the cusp of financial transformation. As blockchain revolutionizes accounting practices, you're no longer just a spectator.

From implementing smart contracts to enhancing audits, blockchain's impact is profound.

It may have limitations, but its benefits are too significant to ignore. It's not just about keeping up with technology, it's about embracing the future of accounting.